VicPD, CRA, and many other local police agencies are all are urging the public to be vigilant after a sharp increase in the number of reports of the “Canada Revenue Agency” phone scam over the last few days.

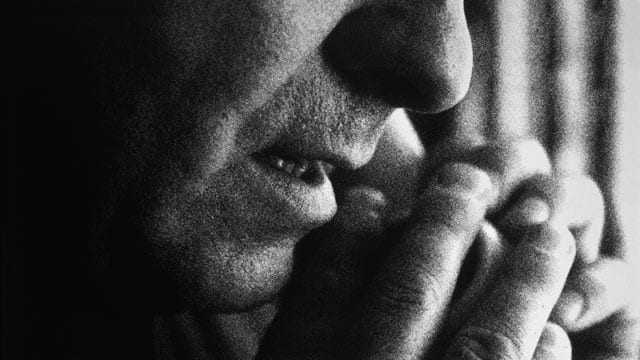

Calls have flooded the local 911 communications centres, VicPD say several citizens have stopped by the police headquarters, traumatized, and in some cases – in an attempt to turn themselves in for what they believed to be non-payment of their taxes.

The scam is typified by a telephone call by an angry caller claiming to represent the Canada Revenue Agency. These callers are particularly aggressive and threaten their unsuspecting victims with arrest and fines. Often, the callers will claim a warrant has been issued for the intended victim’s arrest.

That claim has led several, including some of Victoria and Esquimalt’s vulnerable elderly residents, down to our headquarters for “arrest”. “A reputable government agency will never threaten you with arrest for unpaid taxes over the phone,” VicPD Financial Crimes Detective Sergeant Derek Tolmie.

“If someone calls you claiming to be from the Canada Revenue Agency, you can call them at 1-800-959-8281 to verify.”

Example of a call:

The CRA is urging residents to hang up if they receive such a call. Examples of recent telephone scams involve threatening or coercive language to scare individuals into pre-paying fictitious debt to the CRA. These calls should be ignored and reported to the RCMP.

The Victoria Buzz office had the following message left on its voice message, yesterday: “The reason for this call is to inform you the CRA is filing a lawsuit against you. To get more information about this case file, please call immediately on our department number 1 (613) 927-9687.” The call then abruptly ends.

One Victoria resident, reeling from a phone call with the fraudsters, attended VicPD HQ to face what she believed to be an impending arrest. When our front desk officer approached her, the woman was visibly upset, crying and shaking. It took several minutes for our officer to help calm her down and learn what happened.

“It’s frankly heartbreaking to see, innocent, good people needlessly traumatized by these scammers,” Det. Sgt. Tolmie said.

“It’s frustrating and needless. The best thing people can do is learn to recognize these scams and to talk to their loved ones about them.”

Other examples of recent email scams include notifications to taxpayers that they are entitled to a refund of a specific amount, or informing taxpayers that their tax assessment has been verified and they are eligible to receive a tax refund. These emails often have CRA logos or internet links that appear official. Some contain obvious grammar or spelling mistakes.

The CRA says they would never request someone to pay a debt with prepaid credit cards, and would never ask for passport, health card, or driver’s licence numbers.

To better equip yourself to identify possible scams, the following guidelines should be used:

The CRA:

- NEVER requests information from a taxpayer about a passport, health card, or driver’s license.

- NEVER divulges taxpayer information to another person unless formal authorization is provided by the taxpayer.

- NEVER leaves any personal information on an answering machine or asks taxpayers to leave a message with their personal information on an answering machine.

When in doubt, ask yourself the following:

- Am I expecting additional money from the CRA?

- Does this sound too good to be true?

- Is the requester asking for information I would not include with my tax return?

- Is the requester asking for information I know the CRA already has on file for me?

- How did the requester get my email address or telephone number?

- Am I confident I know who is asking for the information?

- Is there a reason that the CRA may be calling? Do I have a tax balance outstanding?

Anyone who receives a suspicious communication should immediately report it to info@antifraudcentre.ca or to the institution that the communication appears to be from.