If you thought Victoria’s housing prices were unaffordable – you were right. An annual international survey has rated Victoria the least affordable smaller housing market in the country.

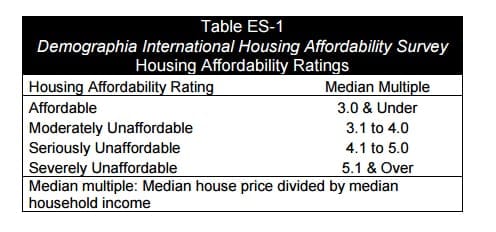

The Demographia International Housing Affordability Survey measures affordability of housing markets by comparing *median house prices to median household incomes, using the Median Multiple. This is obtained by dividing median house prices by median household income.

This Median Multiple has historically hovered around a value of 3 and markets are deemed unaffordable above that rating. The report notes, “For metropolitan areas to rate as ‘affordable’ and ensure that housing bubbles are not triggered, housing prices should not exceed three times gross annual household earnings.”

With a median annual household income of $67,300 and median house price of $542,400, Victoria was rated 8.1, or “severely unaffordable”. Meaning prices are 8 times higher than Victoria household incomes.

As in all of the previous surveys, Vancouver is rated as having the worst housing affordability in Canada. With a rating of 11.8, the city is “severely unaffordable.”

Vancouver also has the dubious honour of being the third least affordable major housing market in the world. The report notes that Vancouver’s house prices rose the equivalent of a full year’s household income in only a year. It follows Hong Kong in first place with a Median Multiple of 18.1, and Sydney at second, with 12.2.

Among major markets, Canada is “seriously unaffordable” with a score of 4.7, with no affordable major markets in the country.

Moncton, New Brunswick, has a Median Multiple of 2.1 making it the most affordable city for housing in Canada.

As the report notes, high housing prices have serious consequences for residents, “The higher house prices reduce discretionary incomes, which reduces potential standards of living and raises relative poverty rates.” Resulting in house poor citizens spending disproportionate amounts of income on home ownership instead of in their communities.

*Note: The median is the middle point of a number set, in which half the numbers are above the median and half are below.