One of the most notable measures announced by Prime Minister Trudeau’s Liberal government in today’s Federal Budget is the introduction of a First-Time Home Buyer’s Incentive.

“Saving enough for a down payment on a home and managing the monthly costs of homeownership can be challenging—especially for first-time home buyers, many of whom are trying to establish or advance their careers, raise young families, or even relocate to a new community,” reads the plan.

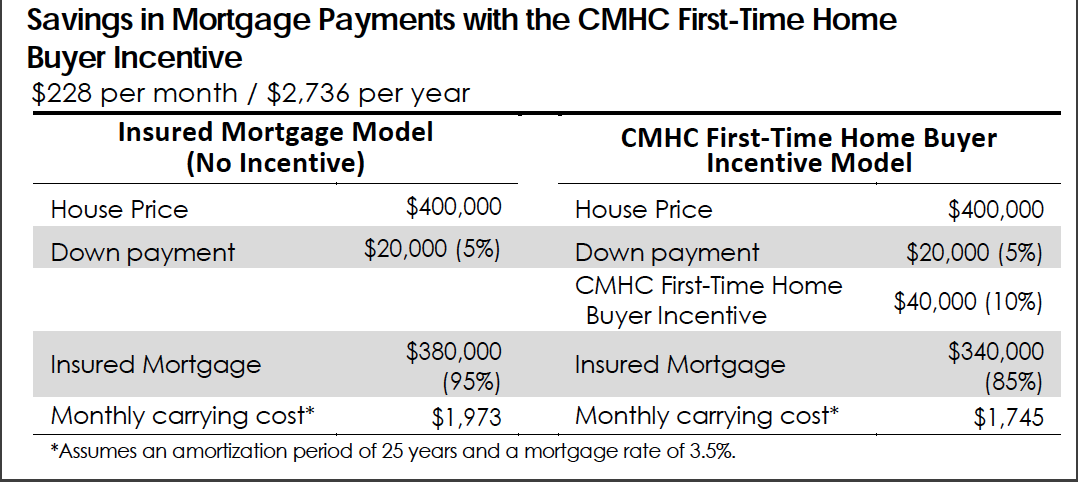

For this reason, the new program aims to make homeownership more affordable for first time buyers by reducing the amount of money required from a mortgage without having to increase the amount required for a down payment.

This announcement will allow eligible home buyers to partake in a shared equity mortgage that would give them the ability to lower their borrowing costs by sharing the cost of buying a home with Canada Mortgage and Housing Corporation.

We’re making affordable home ownership a reality with the new First Time Home Buyer Incentive. Allowing Canadians to get extra help for a down payment on their first home.

— Bill Morneau (@Bill_Morneau) March 19, 2019

See also:

- Federal Budget 2019: Every Canadian will have high speed internet by 2030

-

Federal Budget 2019: Canada will lower student loan interest rates

Starting in the 2019-2020 fiscal year, the CMHC would provide up to $1.25 billion over three years to eligible home buyers by sharing in the cost of a mortgage.

Eligible home buyers include those with household incomes less than $120,000, and participants’ whose mortgage and incentive amount is less than four times their annual household incomes.

The fund will also provide up to $100 million in lending to shared equity mortgage providers over a five-year period, starting in 2019–20, to help existing shared equity mortgage providers scale-up their business and encourage new players to enter the market.

Moreover, the Budget plans to increase the Home Buyers’ Plan RRSP withdrawal limit from $25,000 to $35,000, giving first-time home buyers more funds to help them purchase their new property. This increase is available for all withdrawals made after March 19th.

It also proposes that individuals who face a breakdown in their marriage or common law partnership should also have access the Home Buyers’ Plan.