This just in: According to files obtained by Victoria Buzz, the British Columbia provincial government is facing a class action lawsuit from homeowners in Alberta and other parts of Canada regarding the province’s speculation tax that was announced in the BC Budget 2018.

A letter sent to BC’s Attorney General from international law firm Gowling WLG expresses that homeowners from Alberta “and elsewhere in Canada” are concerned that the tax discriminates against people living in Alberta who own secondary homes in BC, and thus violates section 6 of the Charter of Rights of fellow Canadians which guarantees interprovincial mobility to all citizens.

“As the speculation tax would apply to a person primarily resident in Alberta (or in any Canadian province other than BC) with a home in an affected community in BC, but would not largely apply to a person primarily resident in BC with a home in the same affected community, such tax would discriminate against Canadians on the basis of their province of primary residence,” reads the letter.

The lawsuit thus also claims that the tax discriminates against Canadians and is subject to legal scrutiny under section 15 of the Charter.

Other issues brought up in the lawsuit

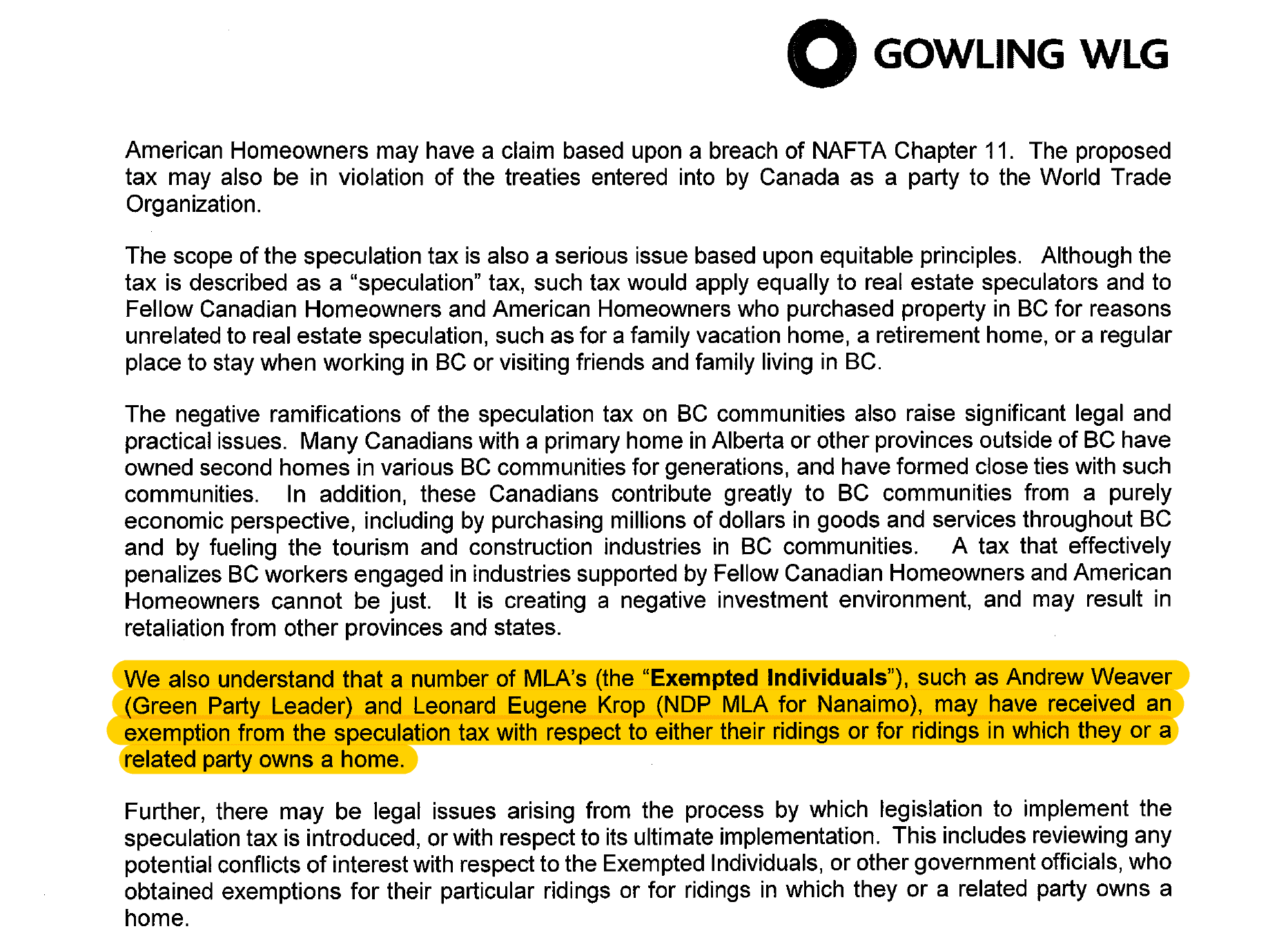

The letter calls out MLAs like Andrew Weaver (Green Party Leader) and Leonard Eugene Krop (NDP MLA for Nanaimo) by name, raising the issue that they and/or their family members may have gotten an exemption from the speculation tax, pointing out that this would raise conflict of interest issues.

The law firm also contends that this class action would be of interest to American citizens who own secondary homes in BC, and may claim a breach of NAFTA Chapter 11 if they join the lawsuit.

This letter was written in order to give notice of the lawsuit to the BC Ministry of Attorney General and Ministry of Finance, and instruct them to preserve all documents, letters, memos, and any communication regarding the speculation tax for the purposes of future legal action.

Victoria Buzz has reached out to the law firm for comment but we have not heard back before the time of publication.

*Reminder: here’s what the speculation tax would look like

Back in late March, British Columbia’s Finance Minister Carole James laid out some clear details to help us understand what the tax would look like and cost:

- British Columbian citizens and permanent residents who own secondary homes in designated areas will be charged 0.5% of the property value in 2018 and beyond.

- Canadian citizens and permanent residents who live outside B.C. will be charged 0.5% in 2018, and 1% in 2019 and beyond.

- Foreign investors and satellite families will be charged 0.5% in 2018, and 2% in 2019 and beyond.

British Columbians who own vacant secondary homes valued up to $400,000 will receive a non-refundable tax credit that will offset the speculation tax, making it null.

People who own properties that cannot be rented out due to specific strata policies will not have to pay the ST, as they will be grandfathered into the current system for the time being.

Certain special circumstances will also elicit exemptions, such as:

- If the property owner has to live in a health-care facility

- Temporary absences due to work

- When the owner passes away and the property is being administered.

See also: Here’s everything you need to know about B.C.’s new speculation tax