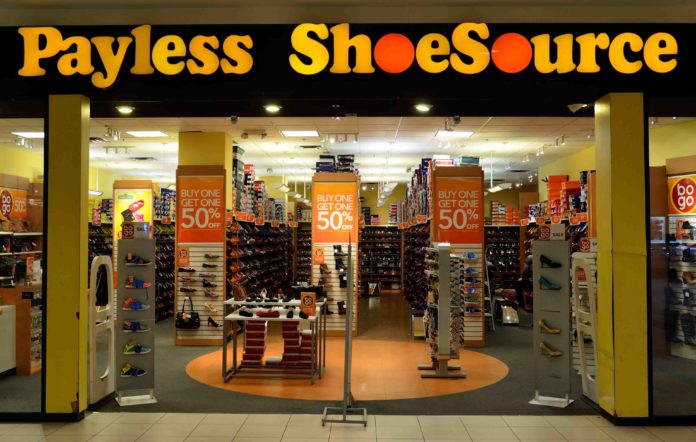

Last week, Payless ShoeSource announced that it would be closing down all of its North American retail stores and concluding operations on its e-commerce platforms this spring.

According to a press release on Monday, the footwear retailer announced that it would be hosting “the largest liquidation event, by store count, in retail history”, with sales happening at all 2,300 Payless locations across the U.S., Canada, and Puerto Rico.

See also:

- Payless Shoes is shutting doors on all of its Canadian locations

- HBC to shutter all Home Outfitters in Canada by the end of the year

- Dollarama now has an online store that ships to all of Canada

Shoppers can expect initial discounts of up to 40% on all merchandise, and sales will continue until all $1 billion worth of products have been sold.

The sale is being operated by a joint venture of asset disposition firms including Los Angeles-based Great American Group, LLC, a wholly-owned of subsidiary B. Riley Financial, Inc. (NASDAQ: RILY), and New York-based Tiger Capital Group.

“Payless has been the go-to shoe store for millions of families, so the closure of its U.S. and Canadian retail operations is significant news in terms of sheer scale and consumer impact,” said Michael McGrail, Tiger Capital Group COO.

A complete store list can be found here.