A newly published report by RBC says that the housing affordability situation across Canada has never been worse and is hitting Victorians where it hurts—their wallets.

Interest rates are continuing to climb as the Bank of Canada is battling inflation, but that means home ownership costs are through the roof.

Since March, as rates soar, RBC says their ‘aggregate affordability measure’ has reached 62.7%. which is the worst it’s ever been.

In every home ownership market across Canada that RBC monitors, costs have worsened.

The bank predicts that the low point of the affordability crisis is likely near. Price decline should be widespread across BC and will help markets stabilize .

According to RBC, benchmark prices should fall by 14% nationwide by the peak of next spring.

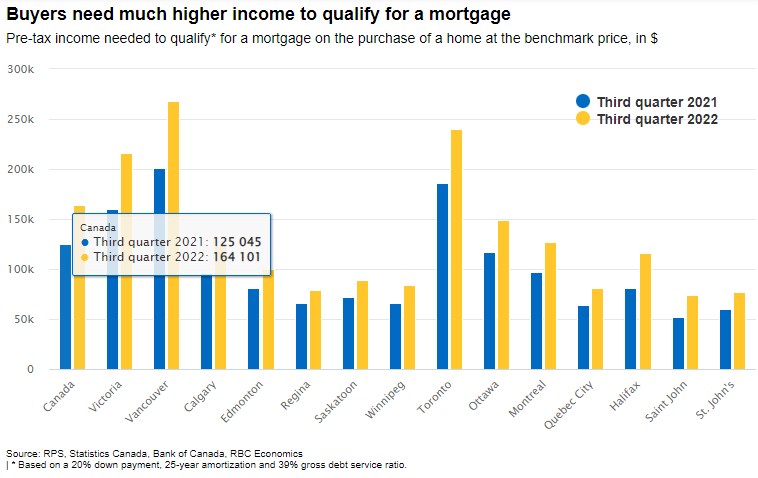

“To qualify for a home valued at the benchmark price, buyers in Victoria must all have six-figure pre-tax income,” said RBC in a news release.

In precise figures, Victorians need to be making at least $216,000 before tax annually to qualify for a mortgage on a benchmark home.

“It’s never been so unaffordable to buy a home in this country,” said the bank.

House resales have plummeted by 43% in BC because of the worst-ever affordability conditions plaguing the market.

Looking ahead, RBC predicts the end is in sight, but we are not quite there yet.

“Affordability issues aren’t likely to reverse quickly. It will take more time for the market to absorb the rise in mortgage rates,” RBC said.

“We expect the market to bottom out around spring.”